Blog

Share

According to data from the Society of Motor Manufacturers and Traders (SMMT) just 1.63 million vehicles were registered in 2020, the fewest since 1992. Another possible blow to dealerships is the likely renewal of BER (correctly known as the Block Exemption Regulations 461/2010). Under BER, buyers can have their new car serviced outside of the dealer network. Under this agreement the manufacturer is obliged to provide access to repair and maintenance data, both from the car itself via the diagnostics port and to the dealership’s computer tool, using tech known as pass-through and cannot restrict warranties to vehicles only serviced within a franchise network. The likely renewal of BER may mean a further loss of revenue to dealerships, with much the revenue from the purchase of a new car previously being delivered within the servicing agreement. More worrying still, are figures from AutoVHC which show that the average dealership is not replacing 66 per cent of severely worn tyres. Not only does this create safety issues for those customers but also failing to sell an average of 50 urgently required tyres per month represents a significant loss of revenue for a service department and plays directly into the hands of competitive rapid-fit operators. The AutoVHC study highlighted that in services carried out in June last year, dealers only sold replacement tyres on 34 per cent of the occasions where tyres were identified as being severely worn or faulty. Data came from a survey of more than 400 UK franchised dealers. More than 28,000 tyres were identified as ‘Red’ during vehicle health checking, meaning there were serious defects, such as an illegal tread depth. However, just 9,000 replacement tyres were sold by these dealerships, leaving around 19,000 dangerous tyres in July alone that were allowed back on the road. Using a common order basket of two medium-quality tyres which cost an average £147.00, and the average missed sales number identified of 70 per outlet, those dealerships lost out on £10,200 for the month of June, which equates to an average for the year of £123,000. So, what are the reasons for this? Partly it could be due to identifying the correct replacement tyre for the vehicle. If a service department team find is difficult to identify the correct specification of vehicle, tyre or component, there is a possibility the sales is avoided. So how can dealerships increase revenue when faced with these challenging times? The answer is simple and one that has been documented for some time. Dealerships need to optimise revenue from all sources and most importantly, increase high-margin, low-risk aftersales opportunities such as tyre sales. Some of the fastest growing dealership networks have been able to maintain and increase revenue through 2020 with the supply of tyre sales. Most importantly these businesses have also recognised that by offering these aftersales services they are able to close their customer retention cycle, maintaining footfall into their dealerships by making sure that the vehicle sale does not conclude their business. It’s also worth mentioning that in the UK, tyre sales are currently classed as essential, so even if your dealership must close, revenue can still be generated from aftersales sources. Current restriction have led to an acceleration in digital retailing, with the coronavirus is credited with speeding up dealerships' adoption of digital retailing tools and processes. Auto retailers had previously been slower to implement e-commerce than some other industries, but that shift accelerated as dealers worked to sell cars remotely when they couldn't in person. That led to more online buying and e-signing options. Best performing dealerships have service departments that have rolled out more contactless options, from mobile check-in capabilities to mobile service vans. Auto repair was generally considered an essential service during the spring shutdowns and dealerships expanded their use of pickup and delivery of customers' vehicles, bringing greater convenience at a time when customers were concerned about health and safety. How can we help? We provide qualified Vehicle, Tyre and Wheel Fitment and Product Data, enabling you to visualise and optimise your products online and within ERP-systems. Our Information is matched to MVRIS in the UK, ACES/AAIA in the US and KTYPE for other countries and seamlessly integrates with DMS, e-commerce platforms and internal inventory systems. Easily access manufacturer vehicle descriptions and specifications, OE tyre and wheel fitments and OE upstep specifications. You can link tyre and wheel images and product data with EAN product numbers, and EU compliant labelling, TPMS specifications and TUV documents where applicable. Available globally with 100% fitment accuracy against vehicles in operation. With data that covers passenger cars, motorcycles and commercial vehicles; all from the same API’s, you can also offer search by License Plate, or Year, Make and Model. It’s simple and easy to integrate with consumer-facing websites, point of sale systems, e-commerce platforms and internal back-office systems. We can offer both REST JSON and SOAP XML so you can decide which approach is best for your needs. DriveRightData’s products and services increase dealership influence and maximise the touch points with a consumer post vehicle sale, thus increasing customer retention. It also creates the support for increased sales and revenue opportunities through enabling the dealer to facilitate a cradle to grave proposition and offer a connected and touch-less environment for the consumer. Often for dealerships, post-sale opportunities for the sale of tyres and potentially wheels are lost to traditional tyre retailers. Use of the DriveRightData API’s supplement aftersales revenue opportunities for networks, improving the consumer user experience through the provision of data supporting the sale of tyres and potentially wheels. The use of data to target the sale of tyre and wheel products, can help the market offset any lost revenues from a potential slowdown in new and used car sales in the months ahead, as the market and wider economy adapt to the impact of lockdown. In addition, it can also help to close the loop on a full, ‘in-life’ vehicle offering to the consumer. With the information gained from the API’s used as a hook proposition. By enabling the dealer / OEM to facilitate a discussion around the purchase of a new or used vehicle, i.e., persuading the consumer to use the money they intend to spend on tyres, as the basis of a deposit on a vehicle. Contact us now to discuss exact requirements or to activate your free trial.

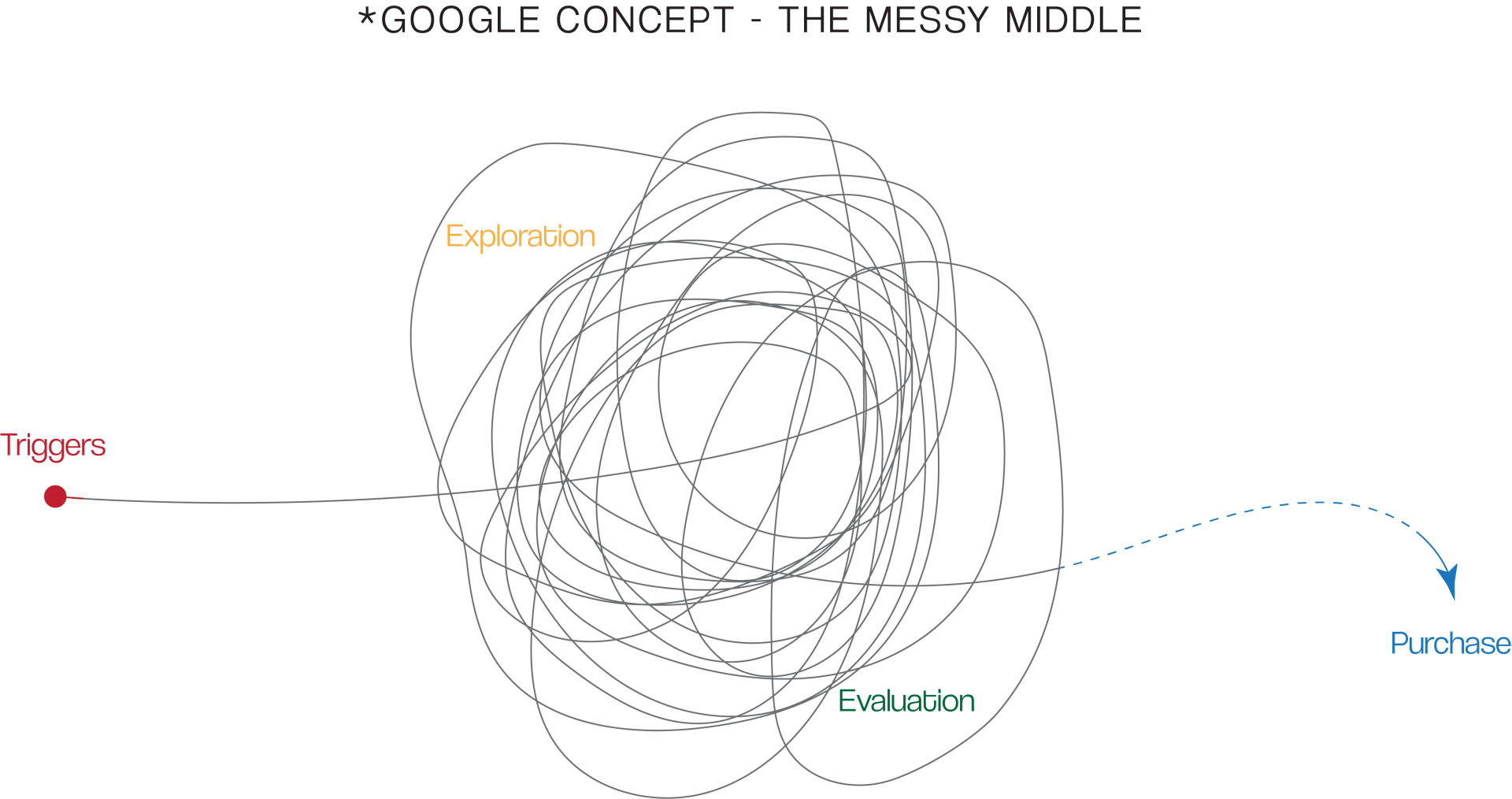

The past few months have been hard on dealerships. Battered by the COVID pandemic, downgraded overall market growth projections for 2019-2020 and predicted growth rates (McKinsey) expected to dip anywhere between 4.9% in an optimistic scenario to 11.6% in a conservative scenario. New vehicle sales have slowed down considerably, which has translated to a slower expansion of vehicles in operation (VIO). According to IHS Markit, 2020 is the fourth straight year the average vehicle age in the U.S. increased, extending a trend over the last two decades during which Americans hang on to their cars and trucks longer. So how is this different from previous recessions? COVID-19 has created an economic situation that is fundamentally different from any previous crisis. According to McKinsey, GDP will decrease, as it typically does during downturns, but the coronavirus crisis will also introduce additional aftermarket-relevant factors that were absent in the 2007 to 2009 financial crisis: fewer collisions, lower retail traffic, a significant increase in digital channels and e-commerce volumes, as well as lower public transportation use. As featured heavily at the recent NADA expo, new factors, such as increased digitization, could have a positive effect on aftermarket sales and potentially deliver a positive and stabilizing influence. Arguably, the most visible change will be the digitalization of parts and services retail across the customer purchase journey. Such trends will accelerate, catalyzing the recovery of the aftermarket. Frost & Sullivan estimate the adoption of digital channels in parts and accessories retail to pick up the pace, expanding by 17% in 2020. It is likely that apprehensions over contamination at workshops will boost the uptake of digitally enabled, on-demand service models, giving rise to contactless options. Accordingly, mobile and contactless delivery of parts and services are predicted to surge. Frost & Sullivan also predict that this will be accompanied by the development of online marketplaces for booking parts and services. If digitalization spurs changes, so does an aging vehicle parc. The average vehicle parc age in the US is already about 11.8 years with such trends echoed in other parts of the world. With these implications and the forecast impact of lower new vehicle sales it is likely that these ages will only increase in the upcoming years; impacting heavily on the warranty revenue usually generated. So how can dealerships compensate for lost vehicle and warranty servicing sales? The answer is simple and one that has been documented for some time. Dealerships need to optimise revenue from all sources and most importantly, increase high-margin, low-risk aftersales opportunities such as tire sales. Dealerships don’t always want to sell tires, but… Auto dealers need tire sales and service to keep customers coming back to their service departments Some of the fastest growing dealership networks have been able to maintain and increase revenue through 2020 with the supply of tire sales. Most importantly these businesses have also recognized that by offering these aftersales services they are able to close their customer retention cycle, maintaining footfall into their dealerships by making sure that the vehicle sale does not conclude their business. Recent restriction have led to an acceleration in digital retailing, with the coronavirus credited with speeding up dealerships' adoption of digital retailing tools and processes. Auto retailers had previously been slower to implement e-commerce than some other industries, but that shift accelerated as dealers worked to sell cars remotely when they couldn't in person. That led to more online buying and e-signing options. Best performing dealerships have service departments that have rolled out more contactless options, from mobile check-in capabilities to mobile service vans and online tire sales. Auto repair was generally considered an essential service during the spring shutdowns and dealerships expanded their use of pickup and delivery of customers' vehicles, bringing greater convenience at a time when customers were concerned about health and safety. Dealerships must be first to offer replacement tires, or it could be the last time you ever see your customer. According to NADA, most customers buy replacement tires from the FIRST person that identifies the need. Since dealerships are likely carry out warranty work on the vehicle up to the time that the first set of replacement tires are needed, it’s likely they will see the customer first. With all of this going for dealerships, one would naturally assume that OEM Car Dealerships could and should dominate the replacement tire business, so why don’t they? The main reason dealers don’t sell more tires is that they don’t prompt the sale. Tires are not checked on all vehicles entering the dealerships, so customers are not aware of their need and are not asked for their order. Dealerships don’t identify the customers need for tires so don’t offer the replacement tires right there on the service drive. This a huge loss of revenue but also can leave the consumer driving a dangerous vehicle. Another major concern, (and a way that independents outperform dealerships) is their lack of investment in technology. If it is hard for the customer or technician to identify the correct tires for the vehicle, the customer will look elsewhere. How can we help? We provide qualified Vehicle, Tire and Wheel Fitment and Product Data, enabling you to visualize and optimize your products online and within ERP-systems. Our Information is matched to ACES/AAIA and seamlessly integrates with DMS, e-commerce platforms and internal inventory systems. Easily access manufacturer vehicle descriptions and specifications, OE tire and wheel fitments and OE upstep specifications. You can link tire and wheel images and product data with EAN product numbers, and EU compliant labelling, TPMS specifications and TUV documents where applicable. Available globally with 100% fitment accuracy against vehicles in operation. With data that covers passenger cars, motorcycles and commercial vehicles; all from the same API’s, you can also offer search by License Plate, or Year, Make and Model. It’s simple and easy to integrate with consumer-facing websites, point of sale systems, e-commerce platforms and internal back-office systems. We can offer both REST JSON and SOAP XML so you can decide which approach is best for your needs. DriveRightData’s products and services increase dealership influence and maximize the touch points with a consumer post vehicle sale, thus increasing customer retention. It also creates the support for increased sales and revenue opportunities through enabling the dealer to facilitate a cradle to grave proposition and offer a connected and touchless environment for the consumer. Often for dealerships, post-sale opportunities for the sale of tires and potentially wheels are lost to traditional tire retailers. Use of the DriveRightData API’s supplement aftersales revenue opportunities for networks, improving the consumer user experience through the provision of data supporting the sale of tires and potentially wheels. The use of data to target the sale of tire and wheel products, can help the market offset any lost revenues from a potential slowdown in new and used car sales in the months ahead, as the market and wider economy adapt to the impact of lockdown. In addition, it can also help to close the loop on a full, ‘in-life’ vehicle offering to the consumer. With the information gained from the API’s used as a hook proposition. By enabling the dealer / OEM to facilitate a discussion around the purchase of a new or used vehicle, i.e., persuading the consumer to use the money they intend to spend on tires, as the basis of a deposit on a vehicle. Contact us now to discuss exact requirements or to activate your free trial.

Successful companies all recognise the importance of data. It’s how they understand consumers’ needs and produce and deliver products to fulfil them. It’s also imperative that they understand which products to manufacture or buy and where to stock them. Parc data reports with vehicle fitment information do just that for the wheel and tyre industry.

Read more to understand how you can use these reports to maximise revenue for your business.

Successful companies all recognise the importance of data. It’s how they understand consumers’ needs and produce and deliver products to fulfil. them. It’s also imperative that they understand which products to manufacture or buy and where to stock them. Our parc data reports with vehicle fitment information do just that for the automotive industry. Quickly understand the number of cars and other vehicles in a region or market with full vehicle information and wheel and tyre fitment. All easily accessible so you can understand your market share locally, regionally or anywhere in the world and cover Cars, SUV’s, LCV’s, HGV’s and Motorcycles. Value to you Organise production or logistics by identifying the lifecycle events and volumes associated with future new vehicle registration Understand vehicle category, make and model selling patterns Identify key trends and hidden opportunities Develop targeted marketing strategies Plan current and future inventory aligned to market requirements Increase brand penetration Identify market share Recognise how many vehicles use a common tyre or wheel size Understand which fitments are increasing or decreasing by various criteria such as size, speed index and group (e.g. Premium / Mid-Range / Economy) Use our data to understand which products are required by which markets and understand your brands market share and performance for each territory. Understand brand/vehicle selling patterns, key trends and hidden opportunities. Develop targeted marketing strategies and plan future inventory. How can this help your business? By fully understanding market trends and vehicles in operation, you can not only increase sales but also improve margins and profit across your whole supply chain. You can ensure that you meet environmental targets by improving production efficiencies and reducing waste products. And, because you can produce the exact specification, size and performance to match market demands, you can also ensure that any stock returns are reduced. Each report gives you foresight of future market need and the ability to understand new car increases/decreases and their fitment requirements. Understand geographic concentrations of your best customers to optimise your location footprint. Because you can produce the exact specification, size and performance to match market demands, you can also ensure that any stock returns are minimised. Each report, gives you foresight of future market requirement and the ability to understand new car increases/decreases and their fitment requirements. With ever rising tyre and operational costs, it can be a constant battle for tyre manufacturers to maintain profitability. By understanding your market and optimising stock, you can increase revenue and drive huge savings straight to your bottom line. Through our data and analytical capabilities, we provide building blocks for growth. We help businesses to identify and reach new markets and to find and keep profitable customers. Improve accuracy by fully understanding your logistical requirements. Reduce lost sales by ensuring you can stock the right tyres in the right locations to maximise your sales revenue. Recognise how many vehicles use a common tyre or wheel size and understand what tyre and wheel fitments are increasing or decreasing by various criteria such as size, speed index and group (e.g. Premium/Mid-Range/Economy) Our reports show the number of cars and other vehicles in a region or market with full vehicle information and wheel and tyre fitments. You can identify new and used vehicle registrations, vehicles-in-operation (VIO), and in some regions we can identify owner demographic types and groupings. All easily accessible so you can understand your market share anywhere in the world. Don’t wait! Contact us here for a free sample report!

Every avenue of revenue needs to be optimized. With new car sales stalling, dealerships need ensure that they are the first port of call for any servicing needs and maximize opportunities such as wheel and tire sales. Many dealerships already offer these services to their customers but investment in technology and the ability to sell effectively online has been overlooked by many. This is where national networks and independent specialists get the upper hand. They understand that the customer does not always know the tire or wheel they need, building technology into their websites such as license plate search and listing which tires and wheels are a match to that vehicle. Some are even able to upsell to the customer by identifying which larger wheels and tires the customer could upgrade to. It is essential for future growth that dealerships become committed to change. By putting the customer at the heart of their business it enables dealerships to remain competitive and relevant. Dealerships need to ensure that the vehicle handover is not the last time that the business sees their customer. Building trust and service solutions to ensure they become the first choice for all their customers automotive needs, not just new car purchase. With the use of intelligent data, dealerships can position themselves to remove the stress from car ownership. It is easier to understand consumers’ needs and provide specialist post Covid services such as contactless tire and wheel fitting. Vehicle collection and delivery with extra sanitization measures to remove any stress for prospective service customers can also be offered; addressing consumer requirements and removing the need for the customer to shop around. What do DriveRightData do and how can they support revenue growth post Covid? DriveRightData are the leading global provider of tire and wheel fitment data, all powered by license plate or chassis drop down search. Supplying the most comprehensive data available, DriveRightData can also provide TPMS data, vehicle, wheel and tire catalogues and even market reports so you can understand local vehicle ownership; by vehicle and by customer group. By giving dealerships the opportunity to understand customers’ needs we provide the data to enable optimized service and experience; creating the online customer solutions that they demand. Businesses can build loyalty and customer retention; constantly improving communication and further understanding of customer requirements. The added benefit is that the service provided builds trust. By knowing that the dealership will always ensure that the customer receives the correct tires, it promotes the added measure of customer safety. The finer details are also important, with TMPS data provided for ease of identification and improved customer journey. The increased sales revenue enables profitability and the ability to match price when required; allowing the dealership to compete against national chains whilst providing better customer service. This means that dealerships not only start to receive increased revenue from aftersales, but the resulting increased footfall provides opportunities for increased new car sales. Savvy salespeople can identify customers who are booked into the dealership for replacement tires and contact them with specialised incentives to convert to a new car sale instead. DriveRightData has proven itself to add real value to dealers, supporting their pioneering ambitions by helping generate additional revenue through a compelling customer proposition and consumer intelligence from a highly regarded brand. For a free demonstration, to find out more about our data or discuss how to integrate our data in your website please contact us using the 'learn more' button below.

Web developers today have a myriad of technologies they can choose from; everything from simplified database access, to easy wrapping of existing middleware services, to a plethora of interesting client-side software. All of these products and tools are there to give web developers the ability to create the best web-based applications in the shortest amount of time. However, having a massive set of possible software solutions is one challenge, picking the specific approach for specific parts of the web applications is another, and web developers today have to juggle many of these decisions with changing standards or approaches seemingly appearing daily. This is why DriveRightData ensure that we have solutions for whichever method is your preference and can support both REST JSON and SOAP XML. Both approaches work and both have advantages and disadvantages to interfacing to web services, but with us able to offer both services, you can decide which approach is best for your needs; readily supported by our experienced team who are on hand to answer any questions or queries you or your developer may have. Contact us to discuss your requirements here: